.png)

Risk Isn't a Guess.

It's a Number.

NIXN quantifies risk in real-time, transforming safety from a compliance function into a competitive advantage. Predict exposure, price risk accurately, and drive smarter decisions—before incidents happen.

Trusted by 500+ organizations worldwide

Safety Metrics Are Broken

Traditional safety reporting relies on historical incidents, lagging indicators, and generic compliance checklists—failing to capture the real risk exposure happening today.

Traditional Safety

- •Historical incident analysis only

- •Manual data collection and reporting

- •Generic risk assessments

- •Reactive approach to safety

- •Limited predictive capabilities

NIXN Risk Intelligence

- Real-time risk quantification

- Automated data collection and analysis

- Task-specific risk assessment

- Proactive risk prevention

- Advanced predictive modeling

NIXN changes the equation by:

Quantifying task-based risk exposure in real-time

Predicting high-impact incidents before they happen

Giving insurers, executives, and contractors the data they need to price risk accurately

Leading Indicators Drive Better Outcomes

More leading indicators tracked correlates directly with improved underwriting performance

Results That Speak for Themselves

Decrease in Claim Frequency

NIXN reduces incident occurrences by enhancing field decision-making and predictive analytics.

Decrease in Claim Severity

With smarter interventions and earlier risk detection, NIXN prevents small issues from turning into major losses.

Direct Cost Savings

Clients see immediate financial benefits by reducing losses and optimizing their risk profile.

Underwriter Confidence Score

Insurers and risk managers trust NIXN's data, leading to better coverage terms and lower premiums.

From Data to Decisions—In Real Time

NIXN ingests, processes, and scores risk exposure dynamically—providing actionable intelligence that drives safer operations, better underwriting, and more profitable decisions.

Over 10,000 Industry Unique ARM Combos

- •Fully customizable to include more granular or industry specific information

- •Easy-to-configure and add in the field

- •Multi-modal (Structured or Unstructured)

Flexible architecture with bundled engines

- •No-code transformation

- •Treating data like code

- •Full provenance through the Job Spec paradigm

Build system that is engine-agnostic

- •Intelligent refreshing / state-tracking across all pipelines

- •Seamless integration with NIXN's risk monitoring

Capture Real-Time Risk Data

NIXN continuously collects data from:

- Job hazard analyses (JHAs/JSAs)

- Site audits and observations

- Incident reports and near misses

- Equipment and maintenance records

- Workforce experience and complexity

Why it matters: Unlike traditional reporting that only tracks past failures, NIXN captures and scores live risk factors before incidents occur.

Quantify & Score Risk Exposure

Proprietary ML models assign risk scores based on:

- Task complexity and workforce capability

- Hazard severity and exposure frequency

- Leading indicators and behavior trends

- Industry benchmarks and patterns

Why it matters: Companies can now see their true risk profile, enabling proactive intervention and precision pricing of risk.

Deliver Actionable Intelligence

NIXN integrates with enterprise workflows to:

- Alert teams to emerging risk trends

- Prioritize highest-impact safety actions

- Optimize insurance underwriting

- Generate actionable reports

Why it matters: No more gut decisions. Every action is backed by real, quantifiable risk data.

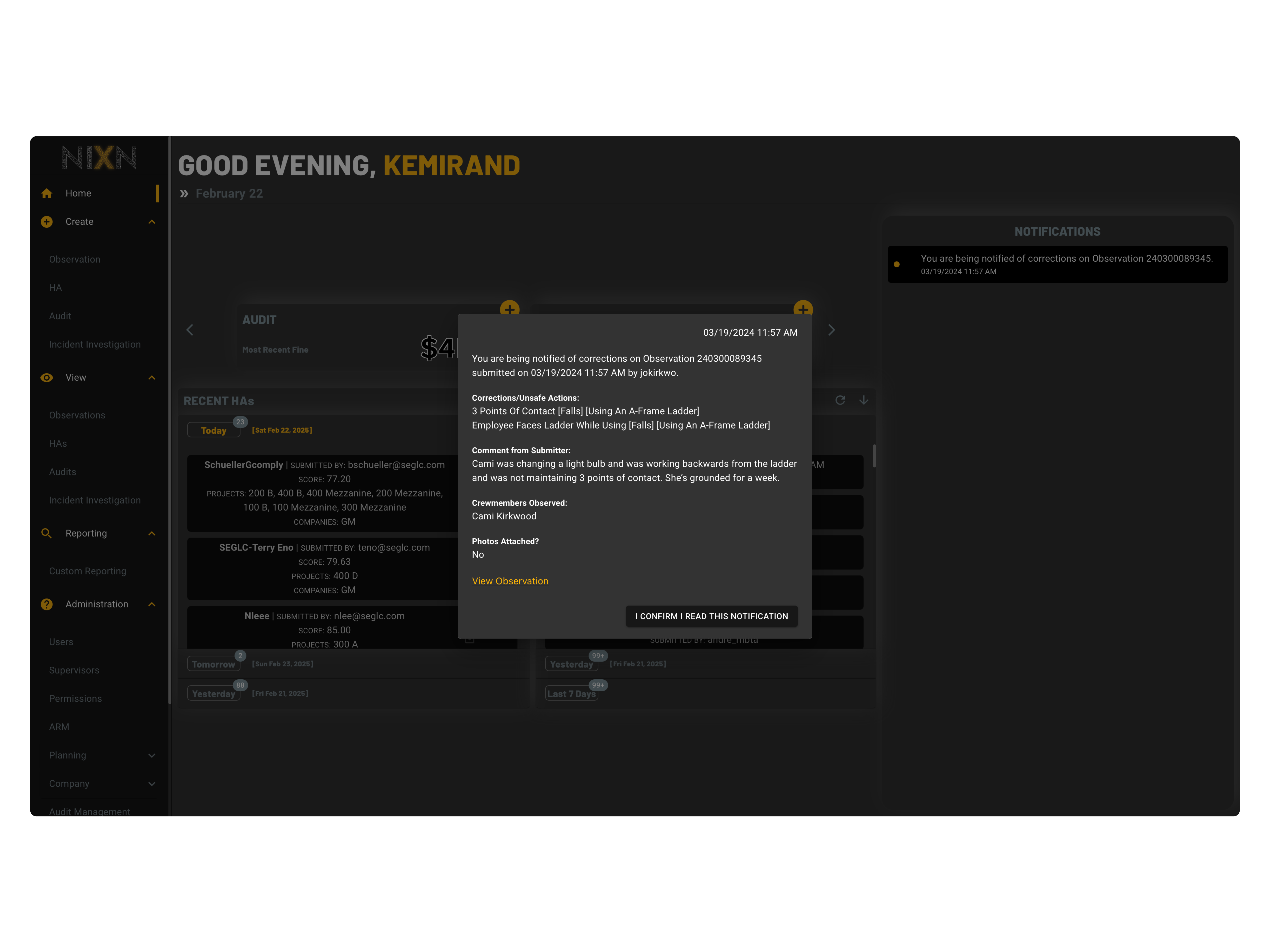

Live Risk Intelligence Dashboard

Real-time visualization of risk exposure across your operations

Action Risk Mitigator Framework

A comprehensive approach to task risk rating - Understanding the relationship between actions, their associated risks, and control measures

Task Identification

Identifies active work tasks and operations

Hazard Assessment

Analyzes potential hazards and exposures

Mitigator Evaluation

Assesses control measures and effectiveness

Real-time Risk Score

Calculates dynamic risk level and exposure

How It Works

- 1

Actions are categorized and scored based on complexity, frequency, and historical risk factors.

- 2

Risks are quantified using ML models trained on millions of real-world data points.

- 3

Mitigators are dynamically suggested based on the specific risk profile and available controls.

Key Benefits

Standardized risk assessment across all operations and locations

Data-driven insights for continuous safety improvement

Real-time adaptation to changing conditions and emerging risks

Predictive analytics for proactive risk management

NIXN Delivers Real Results

NIXN isn't just a tool—it's a transformation engine. Our platform has delivered measurable improvements across industries, reducing claims, increasing risk mitigation, and driving significant cost savings.

Risk Mitigation

NIXN enables organizations to proactively eliminate hazards before they escalate into costly incidents.

Hazards Identified

Real-time data capture ensures that potential risks are surfaced and acted on immediately.

Near Miss Reporting

A massive shift towards proactive risk management, strengthening workforce engagement and accountability.

Five-Year Industry-Wide Results

Ready to Transform Your Risk Management?

Join the organizations that are already using NIXN to reduce risk, lower costs, and drive better outcomes.

Get started in minutes. No credit card required.